By Steve Syre

Analysis of income and asset ownership shows widespread economic risk for elders after working years.

Most older Americans are already struggling to make ends meet or are at risk for a retirement crisis in the years ahead, according to an analysis by the LeadingAge LTSS Center @UMass Boston and the National Council on Aging (NCOA).

The analysis found that 80% of households with adults age 60 and over—or 32 million households—are struggling financially today or are at risk of falling into economic insecurity as they age. This trend worsened over time. Nine of every 10 older households experienced decreases in income and net value of wealth between 2014 and 2016, the most recent periods for which data was available.

“There is a misconception that older adults are asset rich,” said Marc Cohen, a co-director of the LTSS Center, who worked with center research fellow Jane Tavares on the analysis. “Clearly that’s not the case and it’s just as disturbing to see the situation growing worse in the recent past.”

Cohen and Tavares worked on the analysis with NCOA researchers Lauren Popham, Susan Silberman, and Liz Berke. NCOA published their findings in an issue brief, The 80 Percent: The True Scope of Financial Insecurity in Retirement.

HOW RESEARCHERS LOOKED AT ECONOMIC INSECURITY

To better understand the financial landscape for older Americans, researchers from the LTSS Center and NCOA analyzed the latest available data from the Health and Retirement Study (HRS), which surveys a representative sample of approximately 20,000 people in the United States.

Researchers defined a household as financially secure if its total net wealth could cover the costs of housing, food, other necessities, and long-term care, if needed. The net value of total wealth is the sum of a household’s housing and financial assets, less debts.

The researchers defined an “at risk” household as one with some savings and assets that could potentially meet current needs, but not enough savings and assets to cover a financial shock or catastrophe. Financial shocks are major, unexpected expenses, including medical bills, necessary home modifications, long-term care, and losing one’s job if still in the workforce.

A GROWING RISK OF FINANCIAL SHOCK

The likelihood of experiencing financial shock is high as people grow older. Over a 9-year period, more than two-thirds of adults aged 70 and older are likely to experience at least one negative shock with financial consequences, such as falling into poor health, becoming widowed, or losing the ability to work or live independently, the researchers said.

The risk of having substantial long-term care costs is even more pronounced. Half of people aged 65 and over will have a significant need for help with 2 or more functional limitations or with dementia-related issues. Nearly 1 in 6 will need care for more than 5 years, incurring an average of more than $260,000 in lifetime expenses. Long-term care represents the single largest financial risk faced by older adults and their families.

ECONOMIC INSECURITY AMONG SEGMENTS OF THE OLDER POPULATION

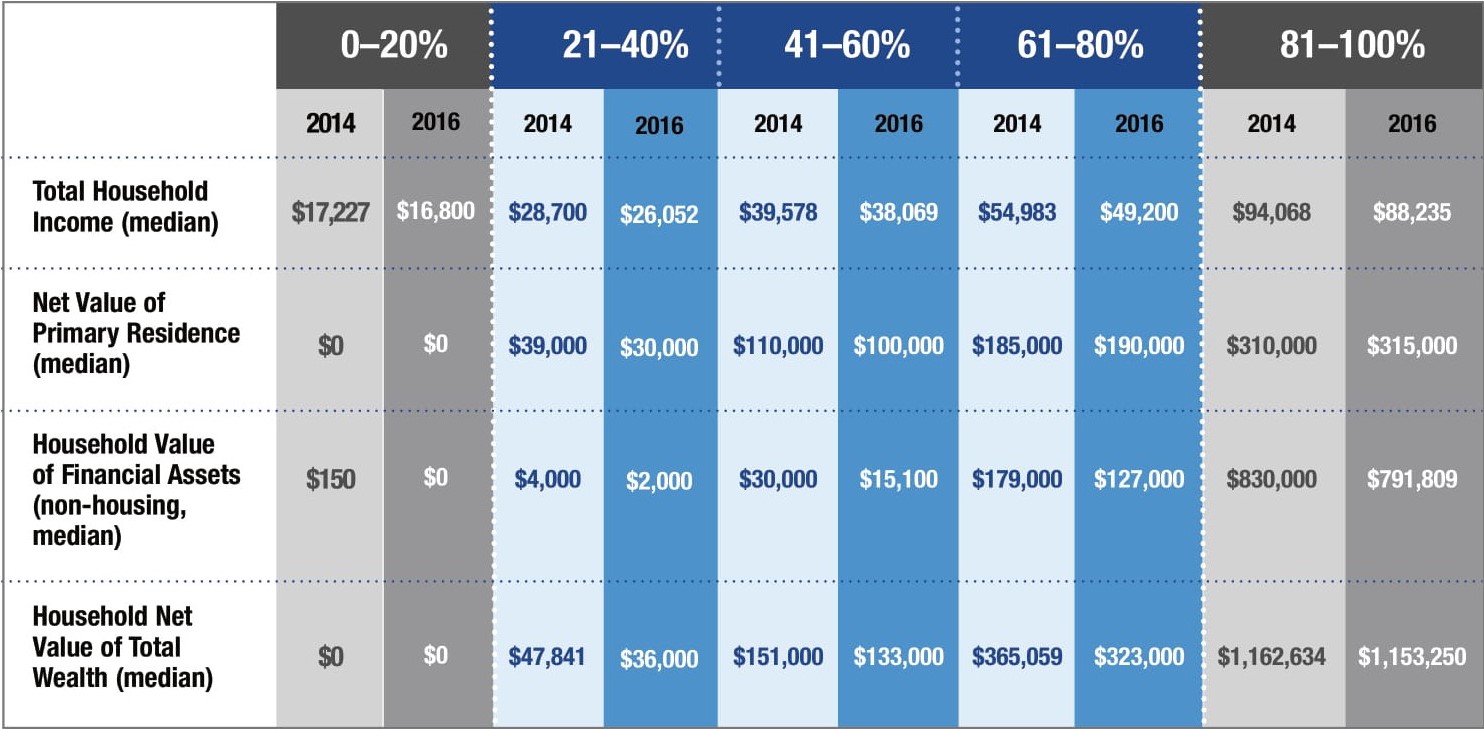

As part of their analysis, researchers segmented the HRS sample of adults aged 60 and older into 5 groups based on the net value of total wealth. Each group represented approximately 8 million older U.S. households. The research team examined several financial measures of well-being across the 5 groups and compared data for 2014 and 2016 to look at trends over time.

Older adults in each of the 5 groups experienced declining median net income and household net worth. Elders in the lowest 2 groups had household net worth of $40,000 or less.

“What is particularly eye opening is the extent to which individuals in the lower 40% of wealth distribution have so little in the way of a financial cushion,” said Tavares. “Sadly, the people who are the least able to handle financial shocks are also the most likely to actually incur them.”

Adult Households Age 60 and Older Segmented by Total Net Worth

ADDITIONAL RESEARCH ABOUT ECONOMIC INSECURITY

The LTSS Center/NCOA research team have also published issue briefs exploring the financial impact of the COVID-19 pandemic on older adults:

- Economic Insecurity for Older Adults in the Presence of the COVID-19 Pandemic.

- Potential Financial Impacts of the COVID-19 Pandemic on Minority Older Adults.